- Home

- About Us

- ServicesDomestic BankingInternational BankingWays of BankingDomestic BankingInternational BankingWays of Banking

platformsATM cardsDeposit

platformsATM cardsDeposit - Location

- Terms & Tariffs

- Registration

- Media

- Contact

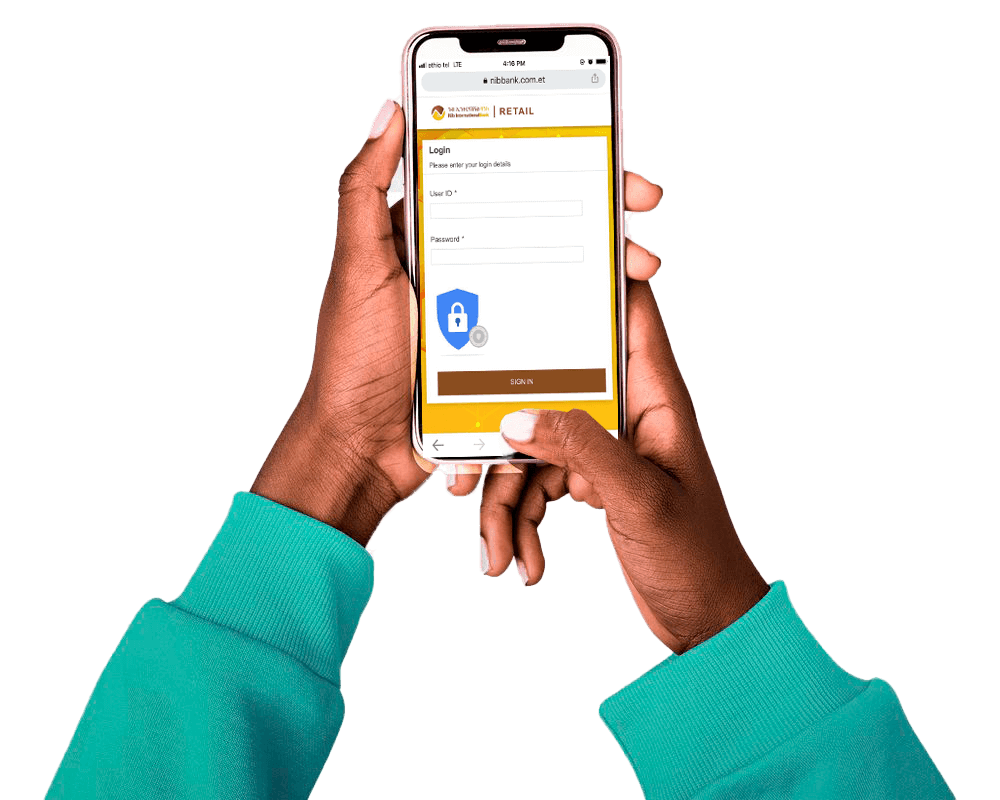

Internet Banking

NIB mobile banking is a mobile banking solution that enables you to access and manage your bank accounts 24/7 through your mobile phones. With this app available, we are placing a lot more value on your own time, and you can do your banking from home – or better yet, from anywhere. It provides you with a secure, easy and reliable access to your accounts. Viewing you account balance, managing beneficiaries and transferring fund are some of the many banking activities you can perform through this app.

NIB USSD provides a method for you to fulfill your banking needs without a need for a mobile data connection. Just dial *865# and follow the instructions displayed.

©2024. Nib International Bank. All Rights Reserved.